Gestão completa da esteira de crédito e venda de recebíveis baseadas em Inteligência Artificial

Solicite uma demonstraçãoGestão completa da jornada de crédito, do pedido à aprovação, tudo em um único lugar

Conheça os benefícios para o agroUma plataforma que conecta investidores a produtores qualificados do setor agrícola, reduzindo incertezas e aumentando retornos

Conheça os benefícios para investidores

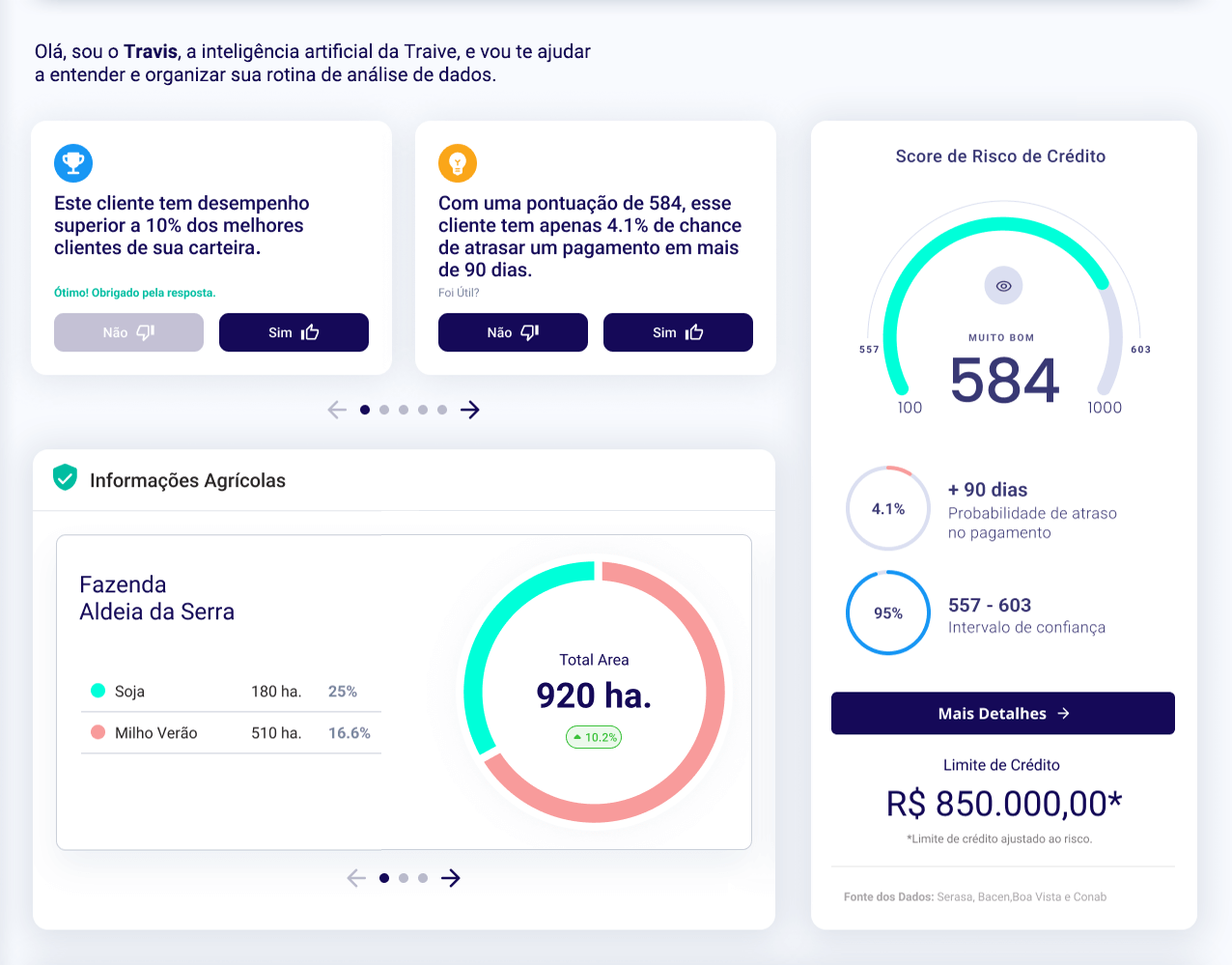

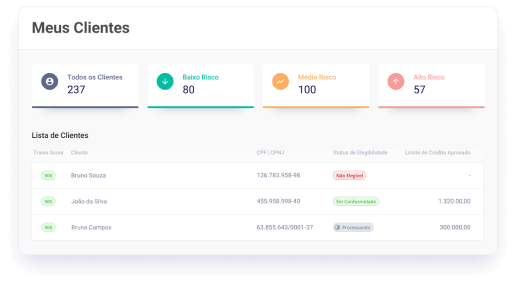

Melhore suas análises de risco com a IA que processa mais de 2.500 variáveis para decisões mais precisas em menos tempo.

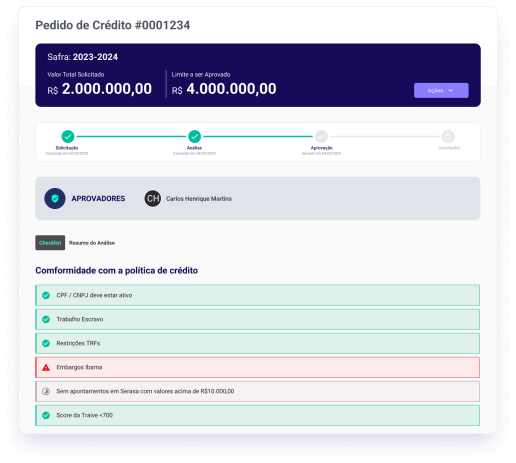

Gestão automatizada com base em sua política de crédito e venda de recebíveis em um só lugar.

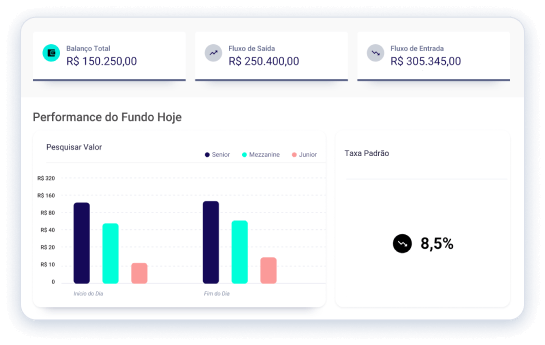

Diversifique sua carteira com recebíveis lastreados das melhores empresas do agro, tudo 100% digital.

Uma plataforma completa de análise de risco com o poder da Inteligência Artificial para identificar os melhores parceiros e traçar estratégias de sucesso.

+55 (11) 3031-8118

©Traive 2015 – 2023 | Todos os direitos reservados